Looks at growth style, momentum and quality factors to target high-growth opportunities. Types: Strategic Beta, Daily Bull 1. What are iShares mutual funds? Highland Capital Management ETFs. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period.

Turn Panic Into Opportunity. Click Here for Details. Factor Characteristics).

For the major indices on the site, this widget shows the percentage of stocks contained in the index that are above their 20-Day, 50-Day, 100-Day, 150-Day, and 200-Day Moving Averages. FTSE Russell indexes also provide clients with tools for asset allocation, investment strategy analysis and risk management. In theory, the direction of the moving average (higher, lower or flat) indicates the trend of the market.

The portfolio targets long U. The Fund will invest at least of its total assets in the securities that comprise the Index. View the latest ETF prices and news for better ETF investing. We sell Covered Calls on a portfolio of Exchange Traded Funds. Issuer Direxion Investments : Expense Ratio 1. Assets Under Management (AUM) 344. Financial Services 20.

Revenue ETF seeks to track the investment of an index composed of U. The institutional investor owned 4shares of the company’s stock after selling 1shares during the quarter. The fund invests at least of its net assets (plus borrowing for investment purposes) in financial instruments and securities of the index , ETFs that track the index and other financial instruments that provide daily leveraged exposure to. The fund generally invests at least of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index.

Calculated using a month sample population benchmarked to the U. Month T-Bill Total Return Index. The ETF holds mid and large-cap U. Its investments are in companies that are thought to be undervalued by the market. Top sectors are financial services , healthcare, energy, industrials, and technology. Securities and Exchange Commission (SEC). You can diversify your investment portfolio using this ETF.

Fund expenses, including management fees and other expenses were deducted. It is non-diversified. The total expense ratio amounts to 0. The fund replicates the performance of the underlying index synthetically with a swap. Left For Dead Bank Stocks Perk Up, Lifting Volatile ETF Along The Way.

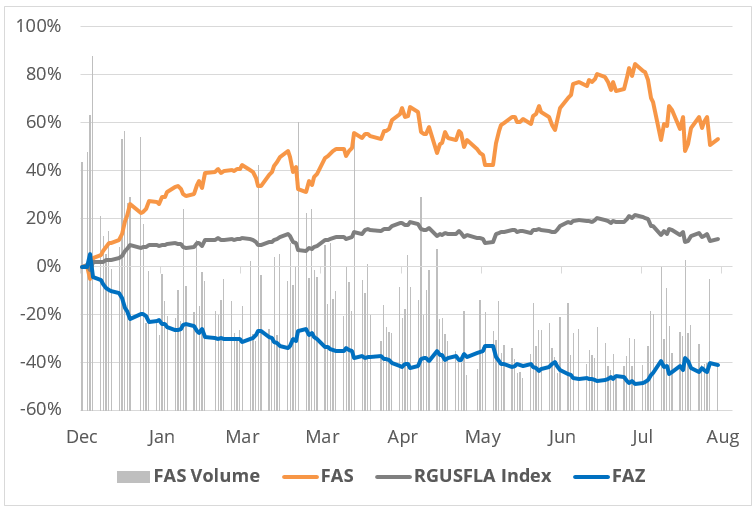

This is because of daily rebalancing. It’s virtually a mathematical certainty that if you don’t catch a massive, sustained trend on the underlying index , due to the daily volatility component, you’re going to lose money over long periods by holding the 3X ETF Short or Long, no matter what. Russell Investments is committed to ensuring digital accessibility for people with disabilities.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.